Borderless Finance 2.0

Q4 | 2023

Mobile app

Finance

1 Product designer

1 Product owner

2 Software engineers

Currently, Nigerians resident in Canada face significant challenges when attempting to purchase items and services for their loved ones in Nigeria. These include the complexities of currency conversion from Dollars (CAD) to Naira (NGN), the financial burden of making full upfront payments, and the limited availability of flexible payment options for such transactions. Traditional methods of purchasing items and sending it to Nigeria often result in high fees, delays, and general inconvenience.

Users need an efficient and reliable way to manage their international purchases and payment plans without the hassle.

Borderless Finance provides split payment solutions over international purchases for users and their friends. With Borderless Finance, people resident in Canada can easily purchase items and services for themselves or their friends and loved ones in Nigeria without having to convert their Canadian dollars to Nigerian naira. The core of what Borderless Finance offers is the convenience of split payments over these purchases. On Borderless platform, users can make purchases of items and services and decide to split the payments over a number of months thereby relieving users of the financial burden that comes with having to make an instance full payment for their purchases.

The primary goal is to design a user-centric interface that effectively supports the split payment model for international purchases and enhances user satisfaction.

In order to gain more insights into the pain points potential customers might be facing, I conducted user interviews and crafted a user persona using the collective personalities, experiences and situations of the interview participants.

I interviewed 4 participants, all Nigerians living in Canada. I was able to get three participants to have conversations with me via google calls, I sent the interview questions I had prepared to the fourth participant and amazingly, I was able to get some useful responses.

3/4

participants have experienced difficulty sending items from Canada to Nigeria

4/4

participants don’t want to go through currency conversion in order to make purchases on Nigerian local websites

3/4

participants have to save up to have the full amount required to make an instant payment for items

2/4

participants sometimes decide to wait for deals and discount periods to reduce cost.

Using the responses and realities of the interview participants, I created a user persona that easily embodies the goals and frustrations of the target audience.

The next step was to create a user flow, which clearly lays out the major user journeys of Borderless Finance app.

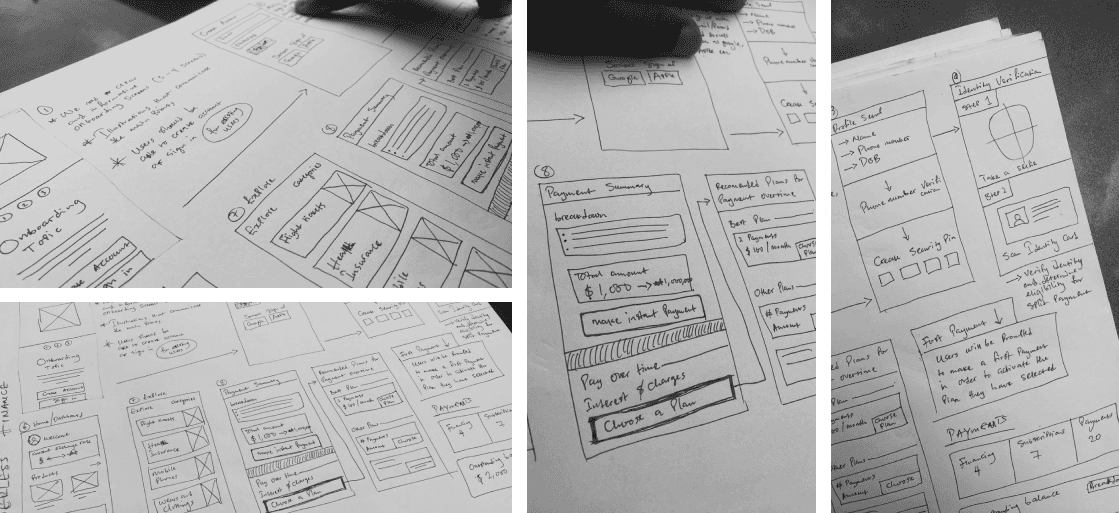

In order to move fast and really solidify the ideas I had in mind based on the research that has been done and what the flow feels like at this stage, I proceeded to put them down on paper and in their raw forms before moving fully into creating the lo-fi and hi-fi designs. I also took this opportunity to write down the purposes and why’s of some of the design elements that I might forget in the design stage that comes after.

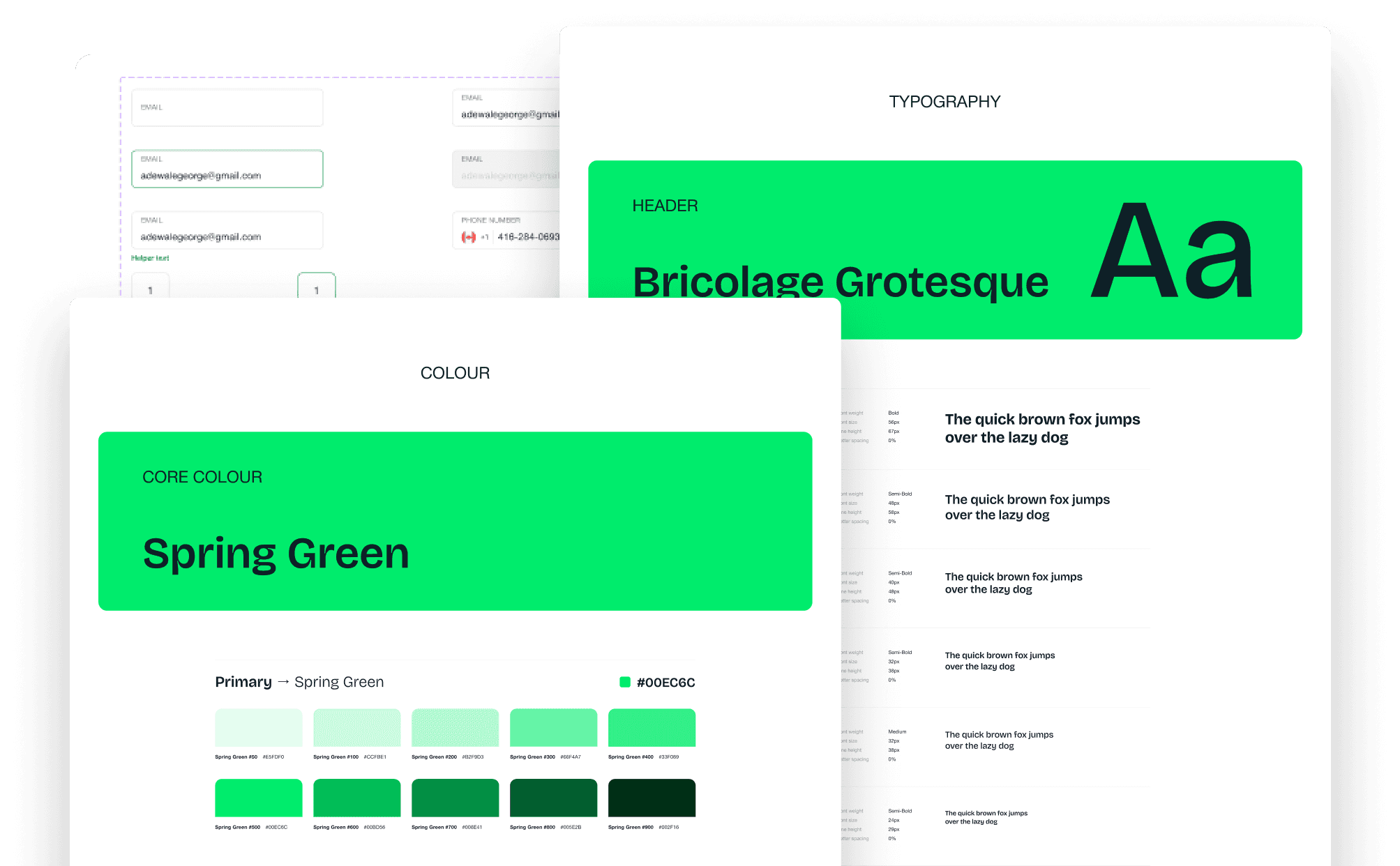

It was important to create a set of laid down rules and guidelines in order to ensure visual consistency across the platform, awesome usability and scalability.

Hi-Fi Prototypes ✨

The onboarding process include clear explanations of the app’s key features, such as range of products, split payments and credit score impact.

For a start, a few partnerships have been secured to provide some products, so the range of products we have decided to start with for the MVP is tailored to the available products in line with the secured partnerships. These products include Flight tickets, Mobile phones and Health Insurance plans.

We discussed the nature and structure of the payment plans we are going with for a start. Users can split payments on their purchases for up to 10 months with an initial down-payment to activate the payment plan.

The app will incorporate a robust payment reminder system that sends notifications to users before each installment is due.

Payment reminders and the option to set up Autopay are crucial features that addressed users' need to manage their finances efficiently. These features are aimed at helping users reduce missed payments and maintained user engagement, while positively impacting their credit score.